Spent a fascinating hour this week shooting the breeze with Nikolai Hegertun and Petter Skjæveland from Norad, the Norwegian aid agency. They’d got in touch to discuss some of the obstacles and challenges they face, look for ideas from elsewhere that might work for them etc etc – I love this kind of conversation. Some highlights:

Aid v Global Public Goods: this is on everyone’s mind at the moment. Norway is leading the way in the OECD in spending an ever larger portion of its aid money on things like climate change, but elsewhere too, aid budgets are being diverted to deal with climate change, refugees, Ukraine and so on. But the aid system is not really designed for those, so as well as starving aid work of cash, it is also not likely to be terribly effective in terms of working on GPGs.

What if you formally separated them – in Norway’s case, sticking with 0.7% of Gross National Income on aid, and adding something else, eg 0.3%, for GPGs? That could allow them to evolve separately – work on GPGs is highly unlikely to involve the same balance of activities as aid – for example between direct funding, leveraging other sources of cash, convening conversations, knowledge exchange, influencing etc, and letting it off the aid leash would allow it to chart a new path. (Also found out that the Norwegian Knowledge Bank does knowledge exchange already on things like fisheries – cool).

‘There’s a lot of fear in the system’: Aid is pretty uncontroversial in Norway (at least compared to the levels of polarization in the UK), but even so there’s a striking asymmetry between success (nobody notices) and failure (banner headlines), that makes aid people highly risk averse. Attempts to persuade those in charge using the language of the private sector, where taking sensible/inspired risks is portrayed as entrepreneurial rather than political suicide, have failed to gain traction.

Part of that ‘stuckness’ is a resistance to long-termism. But Norway has some amazing examples of long term thinking, such as its Sovereign Wealth Fund – why can’t the aid system learn from/ piggy back on those successes? Maybe the shallowness of political support is to blame, but at least a scan of long termism in the Norwegian system might throw up ideas and narratives that could help.

This from Nikolai: ‘there are very interesting similarities: the Norwegian Pension Fund has investments in around 80 countries, it is an important part of Norway’s international relations and “branding”, it has brought Norway as a “small state” into new domains – Norway is not just a “humanitarian superpower” as it likes to underline, but also a financial great power… Yet, the fund is governed quite differently: there is a broad political consensus that it needs to be insulated from political dynamics, it requires a long-term perspective and a high degree of predictability. Aid, with its range of different goals and fragmented nature could really have benefitted from the same kind of discipline.’

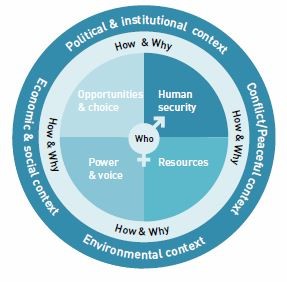

Multi-dimensional poverty: How do we get beyond the rather impoverished (!) notion of dollar a day poverty lines, to capture the lived experience of people living in poverty? OPHI has just published its 2022 Global Multi-Dimensional Poverty Index, which it argues is a big step forward. Norad is also interested in the Swedish multidimensional framework (see graphic).

This reminded me of a debate on wellbeing indicators from 2009 (gosh, this blog has been going on a long time). To be faithful to how people experience poverty, you have to ask them what matters, and expect multiple answers – you can then construct a composite number, based on a dashboard of indicators, but that will be different between each country and (why not?) each city, or even each household. The trade-off is, the more accurately you reflect people’s reality, the less comparable are the numbers.

Or you can junk that whole effort and ask people whether they feel poor/fulfilled etc, and get back to a single universal, but subjective indicator. Unscientific? Maybe, but subjective indicators like business confidence surveys turn out to be some of the best lead indicators of GDP, so maybe not.

All great fun – love my job sometimes!