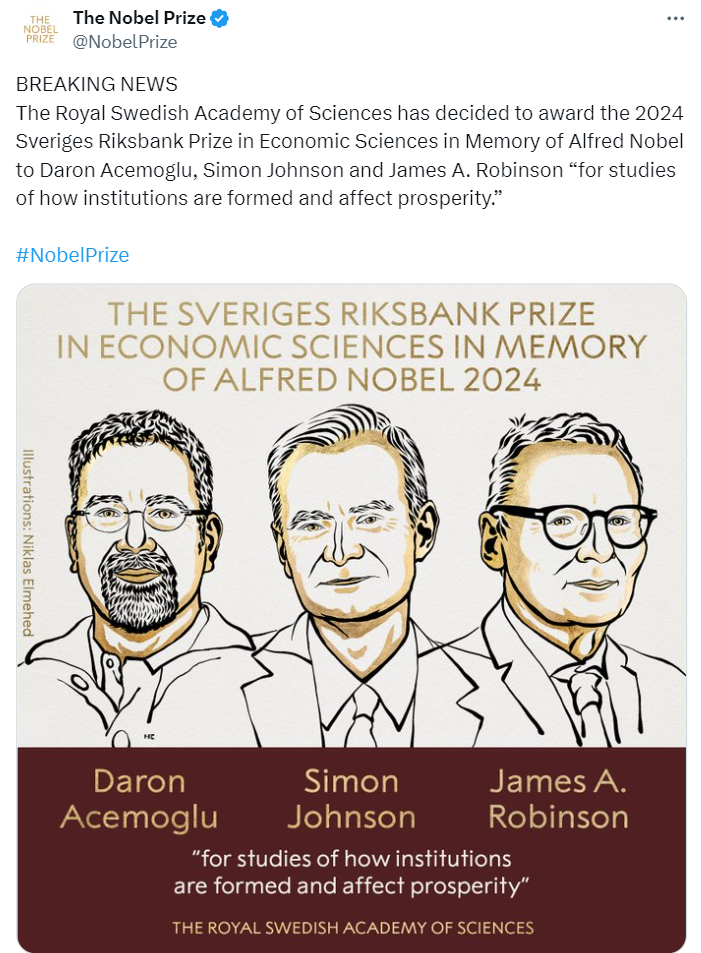

When I heard that the not-quite-Nobel for economics this year had gone to Daron Acemoglu, James Robinson and Simon Johnson I went back to my 2012 review of their breakthrough book, Why Nations Fail. At the time, I had really mixed feelings about it – loved the emphasis on conclusions, but detected an extraordinary level of Western bias on which institutions they thought were effective. Above all, like many Western political scientists, they really struggled with the sustained rise of China. I concluded ‘Overall, the book left me with a sensation of raised expectations, sorely disappointed.’ Francis Fukuyama was similarly critical at the time. The intervening 12 years have, if anything, confirmed my concerns.

Here’s the review:

‘Every now and then, a ‘Big Book on Development’ comes along that triggers a storm of arguments in my head (it’s a rather disturbing experience). One such is Why Nations Fail, by Daron Acemoglu (MIT) and James Robinson (Harvard). Judging by the proliferation of reviews and debates the book has provoked, my experience is widely shared).

First, what does the book say?

‘The focus of our book is on explaining world inequality’, which is essentially a phenomenon of the last 200 years (certainly at its current extreme levels) – the average income of a conquistador was only about twice that of a citizen of the Inca empire.

Inclusive Institutions rock: ‘Countries like Great Britain and the US became rich because their citizens overthrew the elites who controlled power and created a society where political rights were much more broadly distributed, where the government was accountable and responsive to citizens, and where the great mass of people could take advantage of economic opportunities.’

Politics trumps economics: ‘While economic institutions are critical for determining whether a country is poor or prosperous, it is politics and political institutions that determine what economic institutions a country has.’

Failure is the norm: ‘To understand world inequality we have to understand why some societies are organized in very inefficient and socially undesirable ways. Nations sometimes do manage to adopt efficient institutions and achieve prosperity, but alas, these are the rare cases. Most economists have focused on ‘getting it right’, while what is really needed is an explanation for why poor nations ‘get it wrong.’

One of the core problems of most institutional arrangements is that those in power have ‘a fear of creative destruction’ – that the disruptive effect of innovation and capitalism will undermine their power base. The luddites in the presidential palace or the chamber of commerce do far more damage than the protesters on the streets. They therefore act to stifle it – elites’ interests are opposed to those of the long-term development of their country. An ‘iron law of oligarchy’ means that even when oligarchs are overthrown, the revolutionaries, like the pigs in Animal Farm, often come to resemble them. ‘New leaders overthrowing old ones with promises of radical change bring nothing but more of the same’. Understanding how change doesn’t happen is as important as understanding why it does.

In contrast, when a combination of institutional accident and leadership leads to an elite that has reasons to accept creative destruction (as, the authors argue, is the case in the US), then a take off can occur, requiring a rare combination of political centralization and the tolerance of disruption.

The style is captivating – dotted with great historical accounts, amusing and telling anecdotes (in the 16th Century African kingdom of the Kongo ‘taxes were arbitrary: one tax was even collected every time the king’s beret fell off’). Great use of contrasts and ‘natural experiments’ – Mexico v US at the border; Bill Gates v Carlos Slim; North Korea v South. The pace is breakneck, hopping manically between countries and centuries, from the rise and fall of the Roman Empire to the disappearance of the Mayas to the rise of Japan, plucking examples to illustrate the thesis.

The strongest part of the book for me was its focus on the dynamics of change. It almost feels like physics – path dependence is key; minor ‘butterfly’s wing’ differences in initial conditions caused by gentle ‘institutional drift’ make a huge difference when a country hits a ‘critical juncture’ (e.g. the French Revolution, or the Black Death in 14th Century Europe, which wiped out a large part of the labour force and so transformed economies), and can set them on diametrically different paths. ‘The richly divergent patterns of economic development around the world hinge on the interplay of critical junctures and institutional drift. Existing political and economic institutions – sometimes shaped by a long process of institutional drift, and sometimes resulting from divergent responses to prior critical junctures, create the anvil upon which future change will be forged.’

The problem is, much of this only really works in hindsight – almost by definition, there are always lots of minor differences floating around, and it’s impossible to tell in advance which are going to provide the butterfly’s wing that determines that (for example) the industrial revolution takes place in Britain and not Spain.

However, there is more substance than that – revolutions based on broad coalitions (e.g. Britain’s 17th Century ‘Glorious Revolution’) tend to lead to demands for more inclusive political institutions and are less likely to degenerate into copies of the very autocracy they have overthrown.

The trouble with these grand theories is that when they coincide with your own prejudices, they feel like a flawless romp through history. But if you are uncomfortable with the numerous assumptions, explicit and implicit, you get a sense of suspicion and vertigo – it feels like you’re being conned (and the complete absence of footnotes make it harder to check the source of some of the sweeping claims). The reader is being asked to take an awful lot on trust here. And I kept hearing a phrase of Thandika Mkandawire’s in my head: ‘a theory that explains everything, explains nothing.’

The book’s biggest problem is the authors’ love affair with the American Dream (though not American Reality). In their account, successful institutions bear a remarkable resemblance to America’s constitution, separation of powers etc etc. That means that the China question hovers over the book throughout, and their fairly perfunctory attempt to answer it is deeply unconvincing. China is portrayed as on the wrong side of history, pursuing ‘authoritarian growth’, while trying to defy an inexorable push towards matching economic inclusion with the political equivalent.

But can this book really be arguing that China’s economic transformation is substantially more fragile than that of, say, Brazil? Apparently so. ‘Growth under extractive political institutions, as in China, will not bring sustained growth and is likely to run out of steam’ is a hell of a throwaway line, especially when you don’t say whether that might be in one year or a hundred. Nor do they buy into the optimistic liberal account that holds that China’s growth will create pressure for political reform – A &R think it will hit a growth ceiling before that reform happens, with unforeseeable, but chaotic consequences.

More generally on the role of the state, the book seems to swallow the rather discredited argument of the ‘East Asian Miracle’ school that ‘South Korea is a market economy, built on private property.’ (Dani Rodrik and Ha-Joon Chang beg to differ.) The authors systematically downplay the role of industrial policy and a hands-on state in its take-off . ‘[The] process of innovation is made possible by economic institutions that encourage private property, uphold contracts, create a level playing field and encourage and allow the entry of new businesses…. It should therefore be no surprise that it was South Korea, not North Korea, that today produces technologically innovative companies such as Samsung and Hyundai.’. There is no real attempt to explore the concept of ‘developmental states’, a term originally coined to describe Japan’s take-off, but one which is increasingly interesting a range of developing countries as they see the more liberal capitalist economies being rapidly overtaken by ‘state capitalists’ like China and Brazil. But for A & R, the high growth figures of countries like South Korea are always ‘in spite of’ a hands-on state, not ‘because of’.

Which all reminds me of a baffling exchange in 2003 with the FT’s Guy de Jonquieres, as we looked out over the beach at the WTO summit in Cancun (NGO advocacy is a tough gig sometimes). Me: ‘how can you say state intervention destroys economies, when South Korean industrial policy has been so successful’. Guy: ‘But think how much better South Korea would have done if the state had stayed out of it.’ Err, right.

Overall, the book left me with a sensation of raised expectations, sorely disappointed. That was summed up in the book’s bizarre finale. After a hyperactive romp across the millennia this purported survey of what works ends up pinning its hopes on – wait for it – the media, Facebook and Twitter. Oh dear. All that history ends not with a bang but a tweet.’

Pity the Nobel judges don’t appear to have read your 2012 review, Duncan, as time suggests you were on the button in nailing defects in A&R thinking a whole decade ago – quite a feat, so bravo!

it’s taken 12 years+ but we may soon find out who’s right

‘Growth under extractive political institutions, as in China, will not bring sustained growth and is likely to run out of steam’ is a hell of a throwaway line, especially when you don’t say whether that might be in one year or a hundred. Nor do they buy into the optimistic liberal account that holds that China’s growth will create pressure for political reform – A &R think it will hit a growth ceiling before that reform happens, with unforeseeable, but chaotic consequences.

Your review seemed fair at the time and has aged very well. I do think we are free to regard the Nobel choices as, at best, a trifle conventional and behind the curve. More troubling, for me, was their rewarding of the pioneers of the ghastly mRNA vaccine technology.